Partnership Basis Worksheet

Enter prior year ending basis. A Partnership Worksheet can give you a little direction and streamline the process if you decide to go forward and hire an attorney to prepare the official agreement.

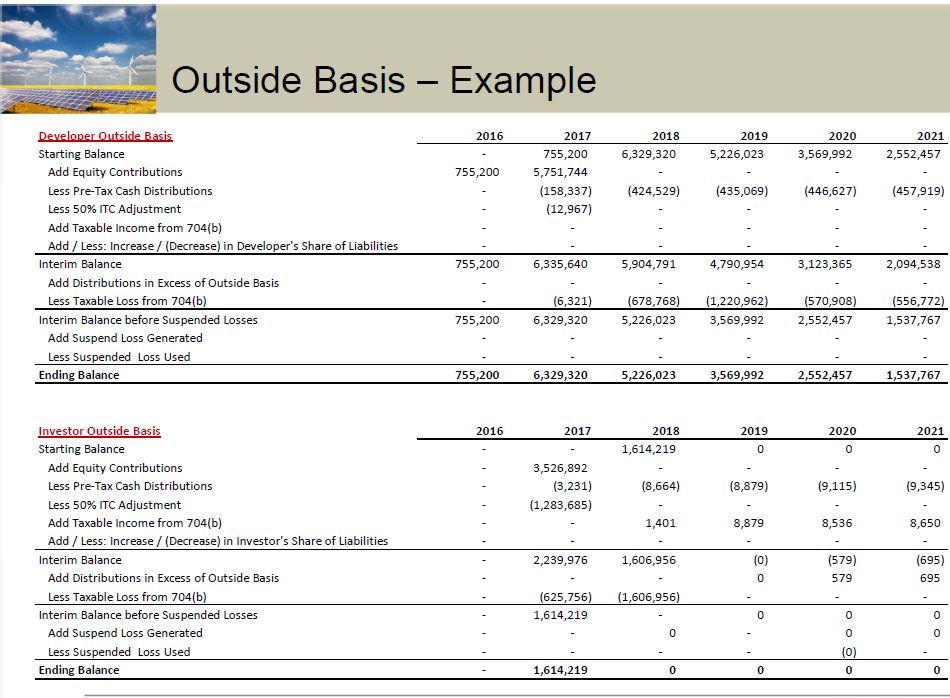

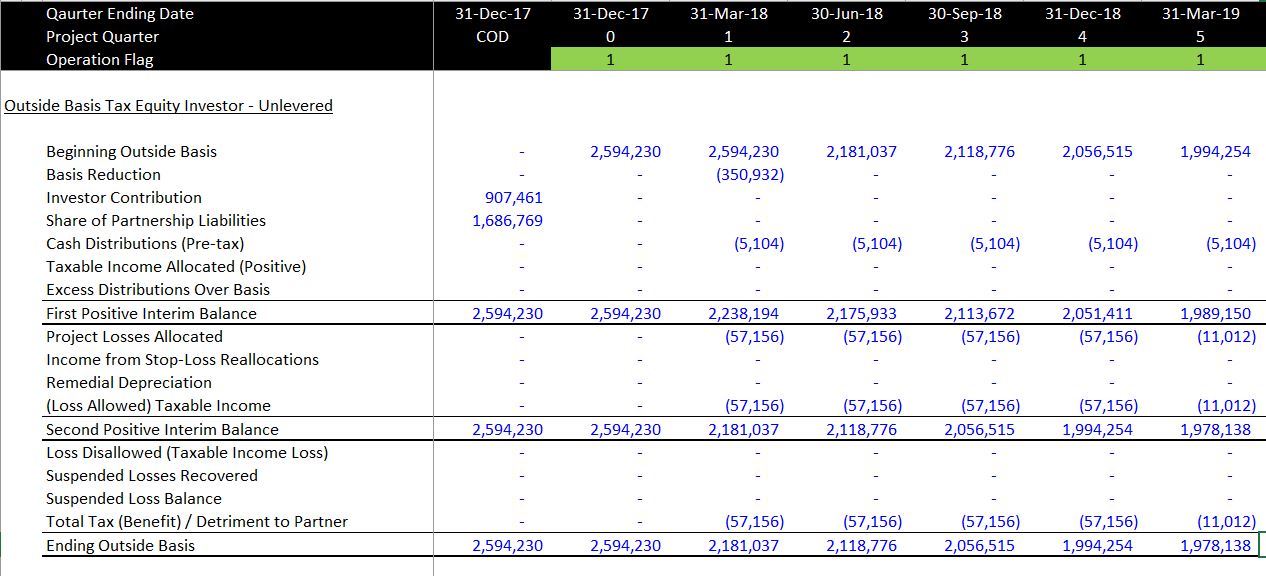

Outside Basis Tax Basis Edward Bodmer Project And Corporate Finance

There is a worksheet for adjusting the basis of a partners interest in the partnership in the Partners Instructions for Schedule K-1 Form 1065.

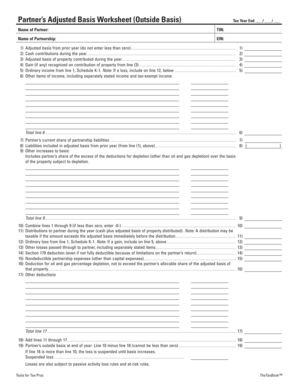

Partnership basis worksheet. Schedule K-1 Input - Select the Partner to be edited. This tax worksheet calculates for carryforward purposes a partners outside basis in a partnership interest. Use the Basis Wks screen Partners Adjusted Basis Worksheet to calculate a partners new basis after increases andor decreases are made to basis during the current year.

Ad The most comprehensive library of free printable worksheets digital games for kids. A version of this worksheet can be generated in Keystone Tax Solutions Pro and is accessed in the Business Program from the Main Menu of a Partnership Tax Return Form 1065 by selecting. The basis of an interest in a partnership is increased or decreased by certain items.

Outside basis refers to basis each partner contributes cash and adjusted basis in property contributed into their partnership interest. Open the form in our full-fledged online editor by clicking on Get form. Interest Outside Basis A partnership interest is an item of property Like any other item of property it has a basis for tax purposes A partners basis in hisher partnership interest is referred to as outside basis Upon formation of the partnership a partners initial outside basis.

Get thousands of teacher-crafted activities that sync up with the school year. Schedule K - Distributive Share Items. Get thousands of teacher-crafted activities that sync up with the school year.

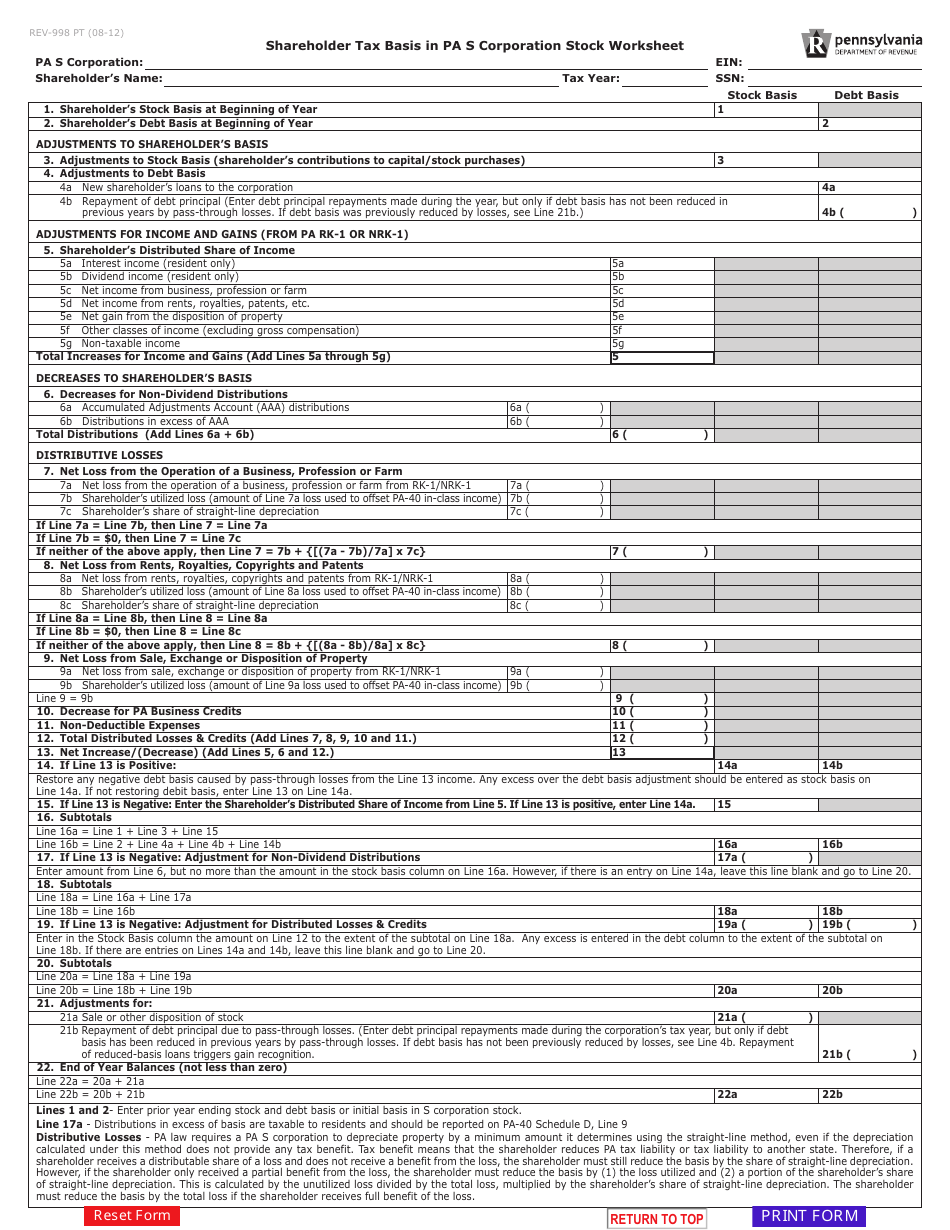

An s corp basis worksheet is used to compute a shareholders basis in an s corporation. 1752-3a provides a three tier formula. Partners Share of Items.

This basis is sometimes referred to as outside basis. Information About the Partner. In this worksheet youll provide information about each owner including whether each party will be a general or a limited partner.

Inside basis refers to the basis the partnership holds in assets and how that basis is reflected in the capital accounts of the partners. Amount of gain that would be allocated under IRC 704c 3. Schedule K-1 Input Select the Partner.

Worksheet for Adjusting the Basis of a Partners Interest in the Partnership. The basis is determined without considering any amount shown in the partnership books as capital equity or similar account. This worksheet can be kept with your yearly tax records so you can easily determine.

Outside basis refers to basis each partner contributes cash and adjusted basis in property contributed into their partnership interest. Can be allocated among partners in proportion to their profits interest E. This basis is sometimes referred to as inside basis Second each partner has an adjusted basis in its partnership interest.

Fill in the necessary fields that are marked in yellow. Information About the Partnership. Other Income Loss Box 12.

Section 179 Deduction. Income Loss Box 11. To open this dialog choose Setup 1065.

This tax worksheet calculates for purposes a partners outside basis in a partnership interest. To help you track basis there is a worksheet within the TaxAct program that will assist you in calculating a partners adjusted basis. Schedule K Distributive Share Items.

Ad The most comprehensive library of free printable worksheets digital games for kids. To assist the partners in determining their basis in the partnership a worksheet for adjusting the basis of a partners interest in the partnership is found in the Partners Instructions for Schedule K-1 Form 1065. To suppress the calculation of partner basis worksheets for all new clients mark the Suppress calculation of partner basis worksheets Screen Basis checkbox in the Other tab in the New Client Options dialog.

For losses and deductions which exceed a shareholders stock basis the shareholder is allowed to deduct the excess up to the shareholders basis in loans personally made to the s corporation see item 4 below. Peter used the following worksheet to calculate his tax basis in ABC partnership and gain or loss from the sales. Press the green arrow with the inscription Next to move on from box to box.

For more information please see Partners Instructions for Schedule K-1 Form 1065 Partners Share of Income Deductions Credits etc. The following tips can help you fill out Partnership Basis Calculation Worksheet Excel easily and quickly. First the partnership has an adjusted basis in its assets.

The adjusted partnership basis will be used to figure your gain or loss on the sale or disposition of partnership interest. To assist the partners in determining their basis in the partnership a worksheet for adjusting the basis of a partners interest in the partnership is found in the Partners Instructions for Schedule K-1 Form 1065. Inside basis refers to the basis the partnership holds in assets and how that basis is reflected in the capital accounts of the partners.

The remaining debt not allocated by applying the rules of Steps 1 and 2. A partners adjusted outside basis refers to the partners investment in a partnership. Amount that debt that exceeds basis in assets 2.

A version of this worksheet can be generated in TaxSlayer Pro and is accessed in the Business Program from the Main Menu of a Partnership Tax Return Form 1065 by selecting. There are two distinct concepts of basis that apply to partnerships and their partners.

Form Rev 999 Fillable Partner Pa Outside Tax Basis In A Partnership Worksheet

Basis In Partnership Interest Is Your Word Good Enough To Support A Loss Deduction Law Office Of Justin Hughes Llc

Outside Basis Tax Basis Edward Bodmer Project And Corporate Finance

Partnership Basis Calculation Worksheet Excel Fill Online Printable Fillable Blank Pdffiller

Https Www Oataxpro Com Assets Files Presentations Be 17 Formation Of Partnerships Pdf

Form Rev 998 Download Fillable Pdf Or Fill Online Shareholder Tax Basis In Pa S Corporation Stock Worksheet Pennsylvania Templateroller

Assessment 4 Partnerships Exercise 2 Worksheet Chegg Com

Assessment 4 Partnerships 2 Exercise 2 Worksheet Chegg Com

Assessment 4 Partnerships Exercise 2 Worksheet Chegg Com

Fillable Online Partners Adjusted Basis Worksheet Outside Basis Tax Year Fax Email Print Pdffiller

Https Www Oataxpro Com Assets Files Presentations 1040 14 Pass Through Entities Pdf

Advantages Of An Optional Partnership Basis Adjustment

Free Partnership Worksheet Free To Print Save Download

Partners Adjusted Basis Worksheet Public Finance Economy Of The United States

Calculating Basis In A Partnership Interest Youtube

Https Farmoffice Osu Edu Sites Aglaw Files Site Library Taxpdf Basis 20reporting 20required 20for 20 202018 Pdf

Advantages Of An Optional Partnership Basis Adjustment

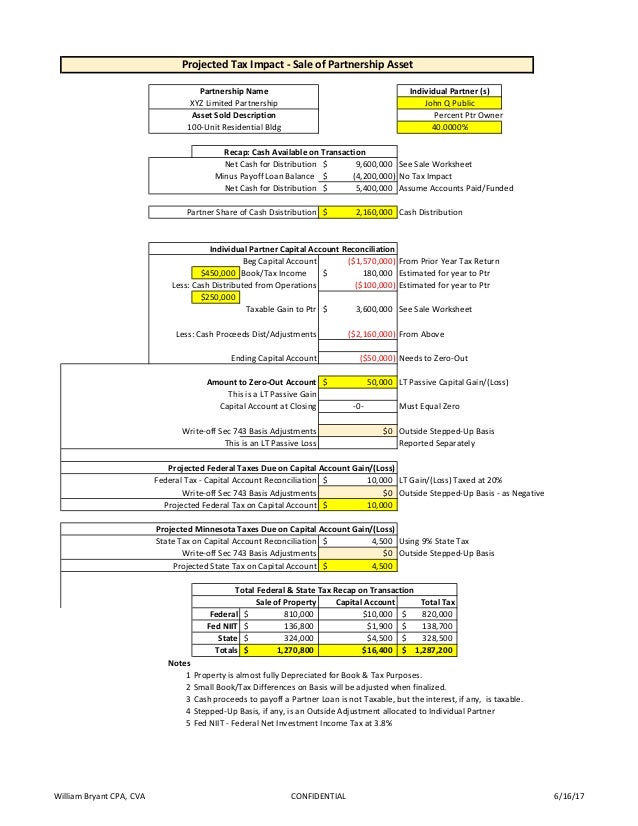

Partnership Sale Of Asset Buy Out Vs Redemption Of Partner Interst